Associations Now recently did a story on my awesome client NICSA and the new membership model project we worked on together last summer. They’ve graciously given me permission to share it.

How one association unbundled some of its benefits and packaged them around “clusters of behavior” in its member engagement data.

The winter of 2014 brought a lot of cold weather and snow to much of the United States. And, with apologies to polar vortex, it also brought us one of my favorite new words: sneckdown.

Both a delightful portmanteau and a revelatory phenomenon arising in urban streetscapes during snowstorms, the sneckdown appears when drivers follow narrow paths through snow-covered roads and intersections. The snow that’s left shows urban planners where curbs (or “neckdowns“) could easily be extended to slow traffic and provide safer crossings for pedestrians.

We were able to make sense of different packages that would reflect or be representative of behavior that we had observed.

The power of the sneckdown is what it reveals about human behavior. This Old City blogger Jon Geeting’s photos of sneckdowns in Philadelphia in February are a perfect illustration of how, paradoxically, a blanket of snow uncovers the most natural paths for cars and pedestrians. Being able to see these paths so clearly makes urban street planning suddenly seem simple.

Behavioral data will do that. Rather than trying to guess what people want to do, or even trying to ask them what they want to do, you can just observe their behavior and design to match it. This is the path that NICSA (formerly the National Investment Company Service Association) followed to a dramatically simpler membership structure last year.

Prior to November 2013, NICSA asked its 170 member companies to join into one of 18 different member categories. In short, 18 was too many, and their aging definitions weren’t keeping up with post-recession conditions in the global investment management industry, anyway, says Michele Liston, CMP, deputy executive director at NICSA. “People were really having a hard time seeing where they fit within the categories, and I think it actually impacted our ability to bring in the dues that we needed to,” she says.

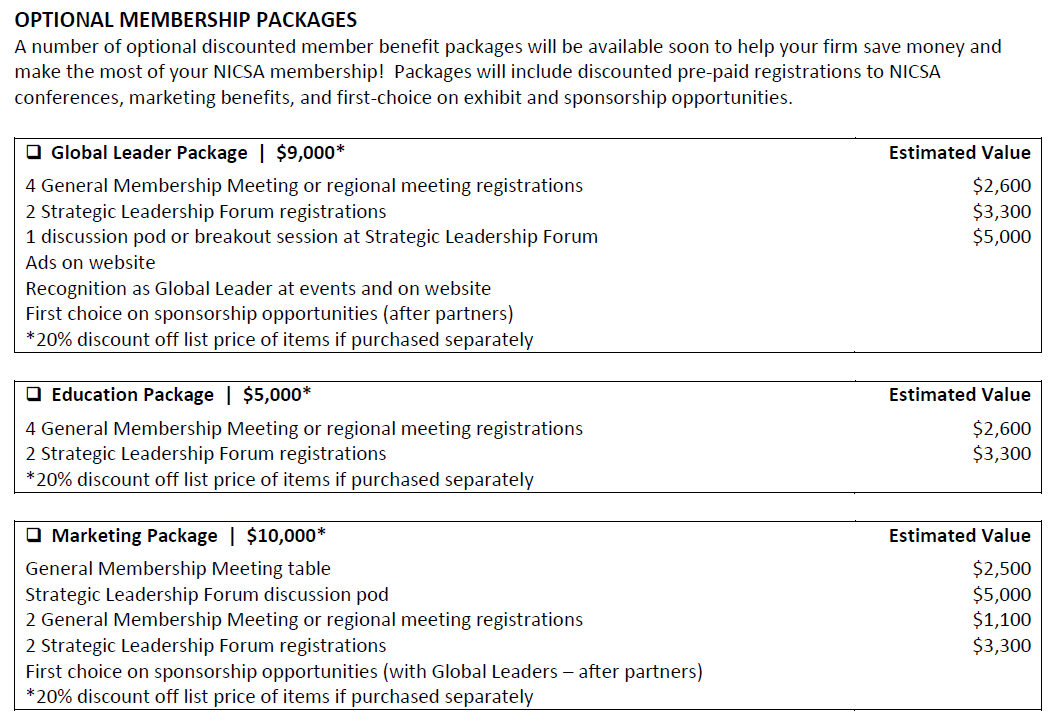

Today, NICSA now offers just five membership levels based on number of employees, removing any ambiguity for the joining member or NICSA’s membership staff. Additionally—and this is where the behavioral data is paying off—members can buy one of three optional membership packages that offer extra benefits at a discounted rate. Each one—the Educational Package, the Marketing Package, and the Global Leader Package—is tailored toward different ways NICSA’s members were already commonly engaging with the association:

NICSA analyzed member activity data to develop three optional membership packages that roughly matched members’ “clusters of behavior.” Click to enlarge.

These “clusters of behavior” were uncovered through analysis of member activity data conducted for NICSA by Elizabeth Engel, CAE, CEO and chief strategist at Spark Consulting. She and NICSA kept it simple, analyzing use of key products and services like conferences, webinars, publications, and exhibitor booths. Looking at the numbers revealed the sneckdowns in the member activity.

“By playing around with different options, we were able to piece together that we have clusters of behavior around these certain number of registrations or certain number of webinar attendances or certain publication purchasing patterns and things like that, and then we were able to make sense of different packages that would reflect or be representative of behavior that we had observed,” Engel says.

So far, the packages have “gone crazy,” Liston says. “We’ve got firms calling us saying ‘Hey, tell me about these packages.’” The cost savings are attractive to NICSA’s financially inclined members, and prepurchasing also offers a “set it and forget it” appeal. They’re also an easy sell because NICSA can show a member company its historical buying behavior and recommend the package that matches. While the base dues rate is up about 8 percent to 10 percent overall, the package discounts mean a member’s “total spend” may go down.

Knowing that total spend data was key to pricing the packages, Engel says. “It was not just how much were they paying in dues, it was how much are they spending as a whole with NICSA throughout the entire year,” she says. It was also vital during the planning process as NICSA tinkered with its options. Being able to plug in historical activity data gave it realistic revenue estimates for any potential combination of dues and benefits packages.

Such a drastic change in membership structure was accompanied by the adoption of a new association management system, Liston says. (This seems to often be the case in these sorts of overhauls.) The transition year has been tricky, but “the fact that we’re simplifying a lot of this, making it less of an administrative burden, is freeing us up to take more time to go after prospects and potential members,” Liston says.

NICSA is preparing for June, when about half of its members come up for renewal. Come November, once all members have been renewed and transitioned to the new member structure, NICSA staff will begin a full evaluation of how the new structure has fared.

From my perspective as an association blogger, I’m a big fan of NICSA’s membership restructure because it reflects at least four different themes we’ve discussed here before: using behavioral data, assembling it all in one place, giving members unbundled options, and putting a clear dollar value on them.

But from your perspective as an association membership pro, you might find NICSA’s case inspiring for its simplicity. NICSA has five staff members, and Engel conducted her analysis in Microsoft Excel. “Don’t let the fact that you don’t have a huge research department and high-level analytical software stop you from looking at your data. Sometimes you just need a little will to make it happen. You can do a lot with the tools most of us have access to,” Engel says. “For small and medium-sized associations, don’t let we don’t have the tools be an excuse. You can still look at what’s going on and say, ‘How are our members actually behaving?’”

How is your association tracking member behavior and engagement? Are you using that data to shape your benefits packages? Where are your association’s sneckdowns? Please share in the comments.

Republished with permission. Copyright ASAE: The Center for Association Leadership, Washington, DC, April 2014.